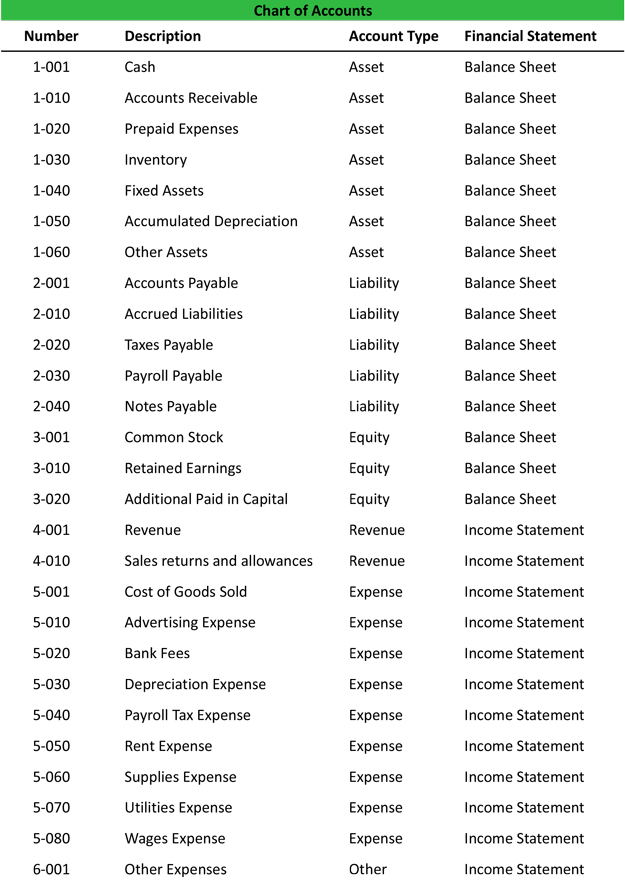

But you need to understand this part of bookkeeping and accounting whether you use a manual system or an online one such as QuickBooks. A chart of accounts is helpful whether you are using FASB, GASB, or special purpose frameworks. This section a chart of accounts usually starts with begins with the account number “2000,” and like your assets, you’ll track both current and noncurrent liabilities. Retained earnings represent the accumulated net income that has not been distributed as dividends to the shareholders.

Liability accounts

Each category will include specific accounts for your business, like a business vehicle that you own would be recorded as an asset account. A well-designed chart of accounts should separate out all the company’s most important accounts, and make it easy to figure out which transactions get recorded in which account. They represent what’s left of the business after you subtract all your company’s liabilities from its assets. They basically measure how valuable the company is to its owner or shareholders. An easy way to explain this is to translate it into personal finance terms. When you log into your bank, typically you’ll get a dashboard that lists the different accounts you have—checking, savings, a credit card—and the balances in each.

Liabilities

Current liabilities are classified as any outstanding payments that are due within the year, while non-current or long-term liabilities are payments due more than a year from the date of the report. Get free guides, articles, tools and calculators to help you navigate the financial side of your business with ease. Our team is ready to learn about your business and guide you to the right solution. Current liabilities are any outstanding payments that are due within the year, while non-current or long-term liabilities are payments due more than a year from the date of the report. Revenue is the amount of money your business brings in by selling its products or services to clients.

- Finance Strategists has an advertising relationship with some of the companies included on this website.

- Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos.

- Income is often the category that business owners underutilize the most.

- Some businesses also include capital and financial statement categories.

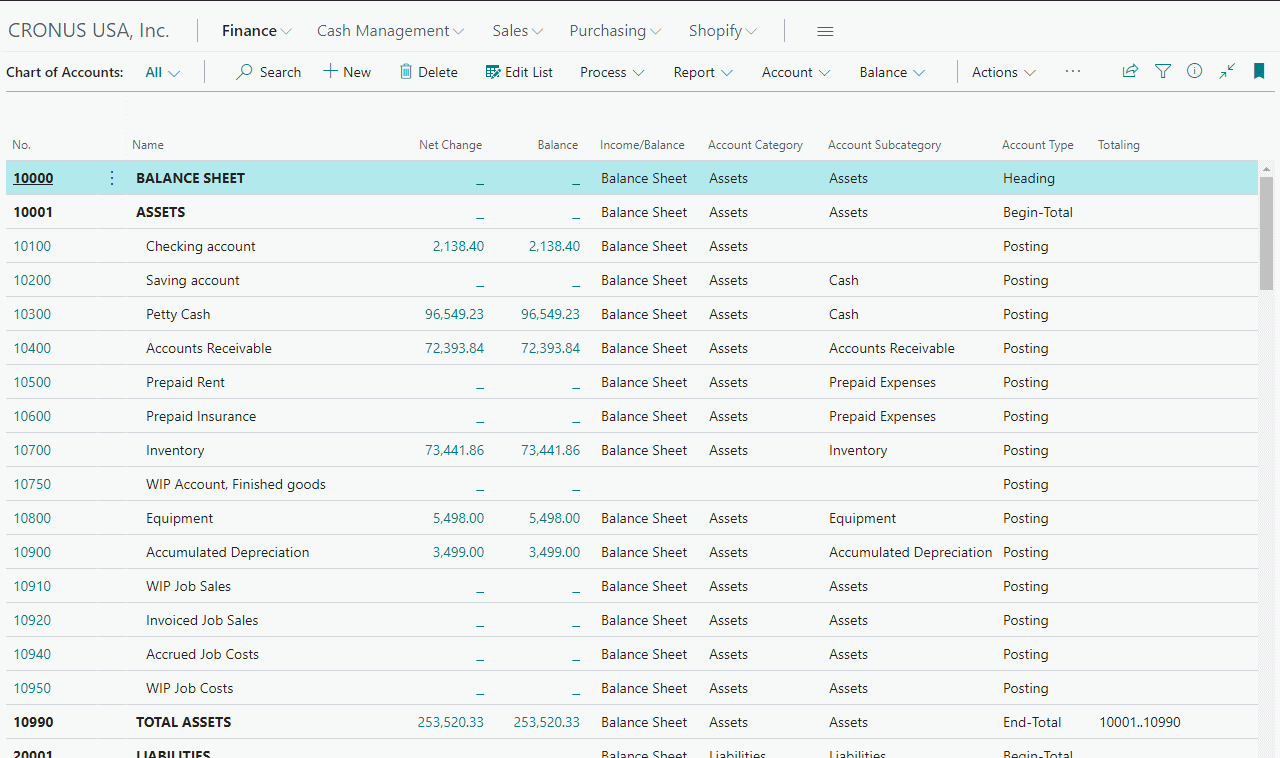

How is a Chart of Accounts structured?

For example, a company might use prefix numbers for specific accounts, such as cash. Here’s an example with the first 10 representing assets and the second 10 representing cash. The structure of the chart of accounts makes it easier to locate specific accounts, facilitates consistent posting of journal entries, and enables efficient management of financial information over time.

Expense accounts allow you to keep track of money that you no longer have. Bookkeepers and accountants use the chart of accounts to organize and keep track of the accounts and account numbers in the accounting system. Kristen Slavin is a CPA with 16 years of experience, specializing in accounting, bookkeeping, and tax services for small businesses. A member of the CPA Association of BC, she also holds a Master’s Degree in Business Administration from Simon Fraser University. In her spare time, Kristen enjoys camping, hiking, and road tripping with her husband and two children.

In our case, this might mean the account falls under the current assets subcategory within the assets category. Revenue accounts display the earnings/incomes the company accrues during a specific period. This orderly listing makes it easier for stakeholders and other interested parties to understand the company’s financial health. The term “chart of accounts” (COA) refers to a list that contains all the accounts that a company uses to record transactions in its general ledger. For example, many accounts that are essential in manufacturing are not commonly used by retail businesses, including the composition of cost of goods sold (COGS). Since different types of entities use different types of accounts, there is no one single chart of accounts template that would be applicable to all businesses.

At the end of the year, review all of your accounts and see if there’s an opportunity for consolidation. Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. Income tends to be the category that business owners underutilise the most.

An expense account balance, for example, shows how much money has been spent to operate your business, whereas a liabilities account balance shows how much money your business still owes. A gap between account numbers allows for adding accounts in the future. As you will see, the first digit might signify if the account is an asset, liability, etc. A chart of accounts will likely be as large and as complex as the company itself. An international corporation with several divisions may need thousands of accounts, whereas a small local retailer may need as few as one hundred accounts.