It’s important to note that only credit sales are recorded in the sales journal. Cash sales, on the other hand, are recorded in the cash receipts journal or another appropriate journal. The sales journal, sometimes referred to as the sales day-book, is a special journal used to record credit sales. The sales journal is simply a chronological list of the sales invoices and is used to save time, avoid cluttering the general ledger with too much detail, and to allow for segregation of duties. All retail companies must have a primary business that makes buying and selling on an ongoing basis.

References

This cash would be noted on the credit side, whereas the LED light would be noted on the Debit side. Sales to customers who pay in cash should not be recorded here, but instead entered in the Cash Receipts Journal. The cash receipts journal is where all cash receipts, which could be payments from customers for the service or product that you sell, are recorded. Also, merchandise or inventory purchases paid by cash should not be recorded in this journal as it is exclusively for credit purchases. The primary purpose of the sales journal is to streamline and categorize sales transactions to make the process of transferring this data to general ledger accounts more efficient. The sale type columns will depend on the nature of business.

What is the Cash Payment Journal? Example, Journal Entries, and Explained

He has been a manager and an auditor with Deloitte, a big 4 accountancy firm, and holds a degree from Loughborough University. The processing load that the clearing agency or credit card issuing bank pays is about 2-3% of the sales transaction figure. In the next section, we’ll talk more about what each debit and credit means for the sale entry.

- It all depends on what you and your company find most convenient and useful for your accounting dealings.

- We must also record the cost of goods sold in the perpetual inventory system and the inventory reduction.

- In addition, for reasons of damaged goods, defects or other reasons, the seller can reduce the price of the goods / provide sales discounts (sales allowance).

- For instance, on July 1st, Elizabeth Walker purchased clothing on credit for $150.

Posting Entries From Sales Journal to Ledgers

For the past 52 years, Harold Averkamp (CPA, MBA) has worked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. An allowance is a price reduction on an item, often because of a sale or a flawed item like a floor display model with a dent. Take self-paced courses to master the fundamentals of finance and connect with like-minded individuals. Ask a question about your financial situation providing as much detail as possible. Your information is kept secure and not shared unless you specify.

- However, if the buyer does not take the discount, the price stated on the invoice will be due in 30 days.

- This is also where we list information about credits and debits so as to form a complete accounting system for recording transactions in double-entry bookkeeping.

- They are important sources of data that can be analyzed to gain valuable financial insights on business operations, performance, and cash flow status.

- However, in reality, many may still use the journal account to record cash sales.

A sale made in cash would instead be recorded in the cash receipts journal. In short, the information stored in the sales journal is a summary of the invoices issued to customers. The best way to record entries is by using flexible accounting software. Many sales journal accounting software options allow entries to be created both manually and automatically.

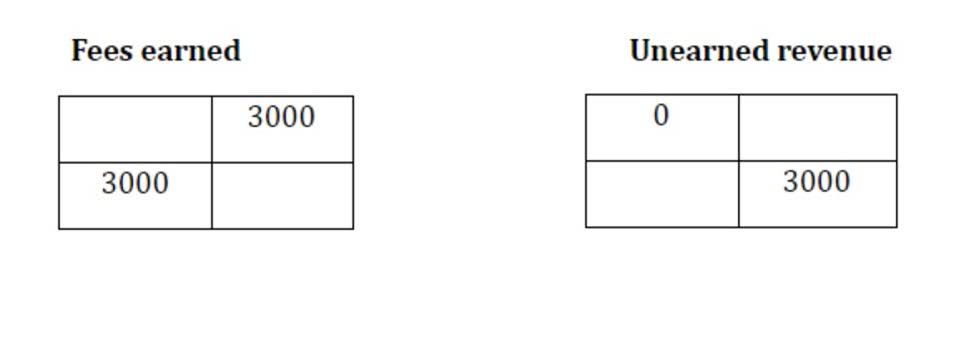

At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content. Finance Strategists has an advertising relationship with some of the companies included on this website. We may earn a commission when you click on a link or make a purchase through the links on our site. All of our content is based on objective analysis, and the opinions are our own. So, when a particular product’s amount unearned revenue goes down, the warehouse is notified of it, and they put more purchase orders for that particular.

How much are you saving for retirement each month?

Just like the purchases journal, only credit sales are recorded when preparing a sales journal. On the other hand, assets sold in cash are recorded in the cash book and the sales of assets on credit are recorded in the proper journal. In this case, the sales account is credited to record the credit sales for the period. Had the sales journal recorded other items such sales tax, delivery fees charged to customers etc, then the credit would have gone to the appropriate tax or income account.

At the end of each accounting period (usually monthly), the sales journal double entry is used to update the general ledger accounts. As the business is using an accounts receivable control account in the general ledger, the postings are part of the double entry bookkeeping system. A sales journal is a journal entry whose function is to record types of credit sales transactions.

It does not only record the cost of purchase, the sales journal entry also notes the date, time, sales tax, and so much more in the sales journal. When recording sales, you’ll make journal entries using cash, accounts receivable, revenue from sales, cost of goods sold, inventory, and sales tax payable accounts. Since the sales journal is used exclusively to record credit sales, the last column (i.e., the amount column) represents both a debit to accounts receivable and a credit to sales. The name of the four sales journals https://www.bookstime.com/ is sales journals, cash receipt journals, purchase journals, and Cash Payments journals.